Left: Stooge du jour, Jerome Powell.

OMINOUS SIGNS

The Fed is likely to start tapering, monetary tightening,

because of rising prices.

Meanwhile, Commercial Banking is limiting lending.Conveniently, cyber attacks are now taking place.

“What’s next?! A crash of financial markets is unavoidable. However, the crash will be sold with a ‘reset’ of the Financial System. This will involve not bail outs, but bail ins: creditors, shareholders, and depositors will be made to pay.”

(KEEP READING FOR CHRIS PIRNAK’S RESPONSE)Source

by Anthony Migchels(henrymakow.com)

The story is that prices are rising faster than expected, and that the job market is overheating.

However, while prices are indeed rising, the other economic facts on the ground are very different: labor force participation rates are still well below the pre-lockdown levels.Not only that, last week it was reported that US consumer confidence cratered to the lowest level in 10 years.

The Biden Administration will be running a $3 Trillion deficit this year. That’s 14% of 2019 GDP.

US Government debt has risen from $22,6 Trillion in 2019, to $28,7 Trillion now, in just two years.

They’re selling this as ‘cuz covid’, but the real reason is that the Government is playing ‘debtor of last resort’, in a desperate bid to keep the economy liquid. However, these numbers are not merely ‘unsustainable’, they’re end game.

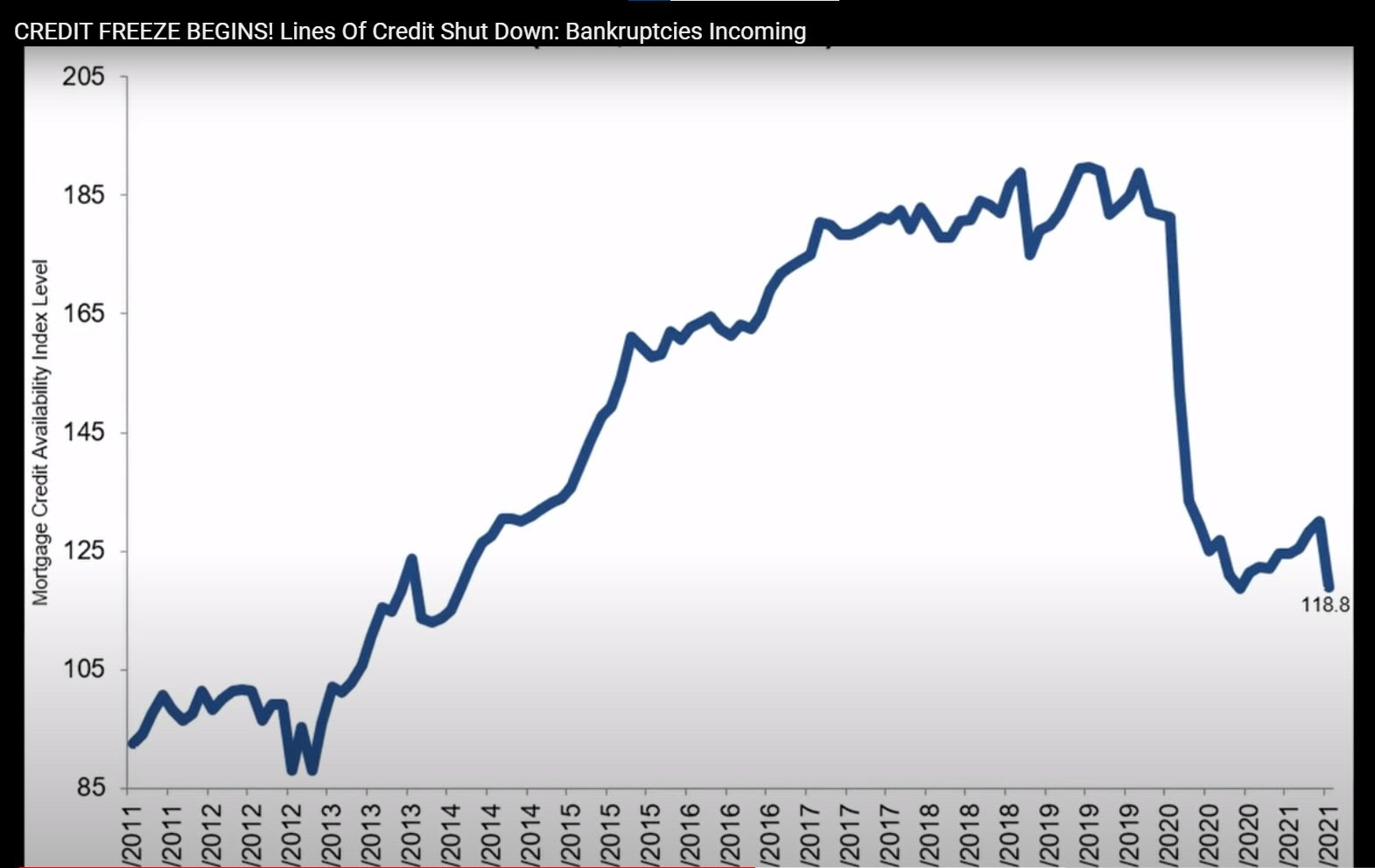

This graph shows how easy it is to get a mortgage. Mortgages represent the by far biggest type of credit to private individuals. This has been ongoing for three quarters already, and now home builder confidence is cratering too, as a result of less people looking for a house.

This is not exactly unprecedented, but previously the Fed had been around to bail out both the Banks, and the real economy with additional liquidity. And these days are now over.

The fact of the matter is, that the Fed are forced to concede. They cannot continue bailing out both the Banks and the real economy. Not without creating a hyper inflation.

That is the key event that is now taking place.

What’s next?! A crash of financial markets is unavoidable. However, the crash will be sold with a ‘reset’ of the Financial System. This will involve not bail outs, but bail ins: creditors, shareholders, and depositors will be made to pay.

All signs indicate they will claim ‘cyber attacks’ did it. Jerome Powell, only a few months ago, said that ‘cyber attacks are the main threat to the financial system.’ It could well be that we will have bank holidays in Western countries, while these bail ins take place. Perhaps also in the US.

Crucially, we’re not just talking ‘a correction’. Also not a mere ‘1987 type crash’. We’re talking bank defaults. And not of small banks, but of the very biggest. It has already happened: the crash in the repo market in September 2019 implied that the big banks didn’t trust each other’s collateral. The $4 Trillion bailout that the banks got in the weekend we were locked up, mid March 2020, gave them a respite. But nothing real has been solved. Wall Street’s derivative bubble is bursting, together with the debt bubble.

November last year, the World Economic Forum ran an exercise involving such an event, caused by ‘nation states and criminal cartels’. They predicted that the Big Wall Street Banks would ‘have to merge to fend of the attack’. ‘To merge’ is Newspeak for ‘we’re bankrupt’.

Wall Street’s problem is that they are on the hook for all the debt via the derivative trade (credit default swaps). And now people can’t pay anymore. This basically is the scenario that we predicted in 2014. This is how the US Empire ends.

WORLD CURRENCY

The WEF also predicted that Russia would install a Central Bank Digital Currency of its own, and disconnect from Western Finance. In the years ahead, private banking will come to an end, as they all go bankrupt. They won’t be able to sustain the payment system, and everywhere CBDCs will be taking over. These will ultimately merge into World Currency, when World Government is officially installed. This is how all money and credit will be ‘nationalized’ in the World Central Bank, just as the Communist Manifesto demands.

Conveniently, cyber attacks have been on the rise the last few months. A German municipality was struck, and couldn’t pay its bills, nor sustain many of its basic operations. The Irish Health Service was hit. And they’re escalating. Last week, Zion was ‘attacked by China’.

Everything bad ‘comes from China’ now. They’re the big bogey man, because the NWO is whipping up a Cold War between the US and them, one that is likely to end in WW3. But of course, China was built up A to Z by Wall Street, and no, they didn’t ‘launch the virus’, nor do they have any enmity towards Zion. They’re already running Haifa, in a 20 year contract, connecting it to the Belt and Road Initiative. Jerusalem too is going to be a major hub. It was just an exercise for things to come.

What is coming is much worse than ‘just another correction’, or ‘recession’. This is the end of an era, of money growth. We’re now facing a monstrous deflation, which will be the cause of the Greatest Depression.

The Greatest Depression will be much worse than the Great Depression. In that deflation, the money supply shrank with two thirds between late 1929 and 1933. It was bad, but it was not genocidal.

We’re now nearing the event that Deagel claimed would lead to massive depopulation in the West. Their numbers are based not on ‘vaccinations’, dangerous as they are, but on the financial calamity that we’re in the middle of, and which is coming to a culmination.

Look at it this way: we’ve had 76 years of monetary expansion, basically the post war boom. Especially since the closing of the Gold Window by Nixon, which is actually exactly 50 years ago. And it is this expansion and associated economic growth that is going to be turned around.

CONCLUSION

The Fed has lost, as it was always going to. This is the Petrodollar’s swan song. They can’t continue providing the economy with the liquidity that it can’t provide for itself, because of already far too high debt levels.

And while the debt bubble deflates, which is catastrophic enough, we will be dealing with rising prices at the same time. Especially for food and basic necessities. The Dollar will lose a lot of value vis-a-vis China in the years ahead, and this will lead to much higher prices for imports from there, also for energy. Lockdowns and other contrived chaos will keep pushing prices higher.

So for us debt slaves, it will be stagflation. The most toxic of all monetary diseases. Stagflation is when the money supply declines (deflation), with the real economy in tatters, while prices rise because of speculation, or other scarcity inducing circumstances.

All this is very hard to swallow. But it is not for nothing that the Lockdown started when they gave the Bank $4 Trillion. The Financial System is the heart of Babylon, and the debt bubble that they have been blowing the last 50 years, and its coming deflation will be their greatest feat. The culmination of 500 years of Usury during Modernity.

It will destroy the West, and its demise will pave the way for the now manifesting World Government.

Afterthought: I previously stated it would happen this Summer. Could still be, we have a month left, but the fact is, while we can see what is happening, only God and the Bankers know when.

——————-

Anthony Migchels is the founder of De Florijn, the first fully-fledged interest-free, privately operated currency in the World. His website is Real Currencies.

Related:

What The Great Reset Is About (Video)

The World Crisis = The Financial Crisis

The New Gold Standard IS The Great Reset!

The Return Of The Financial Crisis September 2019

I asked Anthony how we can prepare for this scenario. His reply:

‘Investing’ is for Bankers. Taking usury and speculation is forbidden for us. In the times ahead, people will need the Spirit’s blessing, far more than money, and he’s very seriously unamused with parasitism.

Why do people complain about ‘degeneracy’ while they make money with money, instead of producing stuff of value to others?

What is the point of complaining about the New World Order while having money in the Bank?!

When the crash comes, and the reset, all that will rise is Gold (and perhaps Silver), all the rest will go to dust. The Stock Exchange will never recover and will keep declining until the end.

Do NOT keep money in the Bank, certainly not lots of cash in one account, in one Bank. Best is to take it out, and keep it cash, with 10/20% Gold coin (part of that can be Silver). That will compensate for all paper losses.

Pensioners especially. Their situation is critical, and they have no idea. They need a bit of Gold. Again: not all in, 10/20%.

And while I’m against crypto, I’m not against many of the people ‘investing’ in it, hoping not only to make a buck, but also to get rid of the Bank. So heed this warning: in the coming mother of all liquidity squeezes, BTC will also take a massive hit. Do not go all in on crypto, keep 10/20% in Gold.

The only reason Gold is going to go up is not ‘inflation’ (there is going to be deflation), but the fact that it will become money again. Especially in China, which will for certain go Gold, they have enormous amounts of it.

Do not try to profit from the coming Collapse. The Gold fever among the gold dealers (‘alternative media’) is disgusting. What is coming, end of Gold Suppression, will be a very dark day indeed for the West.

First Comment from Chris Pirnak-Know Your Adversary

All of what Anthony says could take place over the next decade. Dozens of scenarios are possible.

Ben Bernanke says the Fed balance sheet could go to 100% of GDP and beyond. I agree. As long as the other central bank balance sheets grow. They will.

I have been hearing about this stuff for 12 years now. Every time this gentleman pulls out a federal reserve note, he feeds the system.

Why would there be bail ins when the Fed could continue doing what it’s been doing successfully for 13 years? The talk of bail ins was a possibility before QE was conjured up back in 2008. Some outliers like Cyprus saw some action earlier last decade, but only because they didn’t have the ability to float debt.

If China went to gold now, their debt ponzi scheme would collapse faster than the US’s.

Chris is scathing in his criticism of Migchels in this reply to an Oct. 2019 article predicting a return to the gold standard.

I read the article and it really is just another gold shill article. It does a terrible disservice to those who embrace it. I never invest and predict future events based on a remote outlier event. The author takes stuff out of context.

I just ask one question; Why would the globalists move to a gold-backed currency? They would intentionally destroy the economy and world system for decades AND GET THE BLAME. They would create such chaos that they wouldn’t be able to control. The NWO is being implemented while the people continue to underestimate it.

They can keep this current system all the way to war. War will provide the force majeure to move to the next step. Based on the status of the ChiCom and Russian military, we are at least several years away.

The elites will never arbitrarily move to another system. There needs to be a catalyst. War always has been that catalyst and war will be once again. The elites are very predictable.

The globalists want to change but need a force majeure. The pain from changing the monetary regime is too great for the world at this point and only an exogenous type of catastrophe (exoplanet crashes and destroys the world, global conflict, etc.) qualifies as the catalyst.

I wrote an article earlier today that I think may help a few of your readers who are tired of the shilling in the alt-media

Investing based on our beliefs instead of reality; A lethal philosophy – Know Your Adversary

Reply from Anthony Migchels

1. The Fed can’t continue. Not without creating a hyper inflationary spiral. That’s the essence of the current situation. They’re legally bound to keep inflation near 2%. That’s why they were printing, because there was deflation. But they overshot the mark, and CPI is rising at 5% now.

The same is true of the Government. A 14% deficit is not a joke. It’s a disaster.

Contrary to what ‘Austrian Economics’ is telling us, Bankers hate inflation. Because it makes the value of the debt worth less.

They create bubbles, so they can pop them. And the coming bust will be one for the books.

2. Gold suppression is coming to an end with Basel 3, which will reach the LBMA January 2022.

China can deal with Gold, because they have a lot of it, up to 30k tons. All bought up while the Fed was keeping prices low. They will have a broad monetary base.

3. Remember this quote?

” “The few who can understand the system, will either be so interested in its profits, or so dependent on its favors, that there will be no opposition from that class, while on the other hand, the great body of the people, mentally incapable of comprehending the tremendous advantages that capital derives from the system, will bear its burdens without complaint, and perhaps without even suspecting that the system is inimical to their interests.”

I don’t invest. I loath investing. Everybody who invests, is part of the problem. I’ve never made one buck off the financial system. Also not BTC, which I’ve been following since the beginning. I’ve always worked for my money.

To me it’s about geopolitics and exposing Usury’s key part in it all. America and the West are being demolished. We’re nearing the coup de grace. There will be an unbelievable transfer of wealth and power to the 0,001% AND to the East.

https://www.henrymakow.com